Streamline Procurement with a No PO No Pay Policy

Process Management

Discover how implementing a No PO No Pay policy can streamline procurement processes and enhance efficiency.

The Importance of Procurement in Business Operations

Procurement plays a crucial role in the overall operations of a business. It involves the process of acquiring goods and services that are essential for the company's functioning. Effective procurement ensures that the right resources are obtained at the right time and cost, enabling smooth operations and sustainable growth.

By efficiently managing procurement, businesses can optimise their supply chain, reduce costs, mitigate risks, and maintain quality standards. It is the backbone of any successful organisation, as it directly impacts various aspects, including production, inventory management, customer satisfaction, and financial stability.

What is a No PO No Pay Policy?

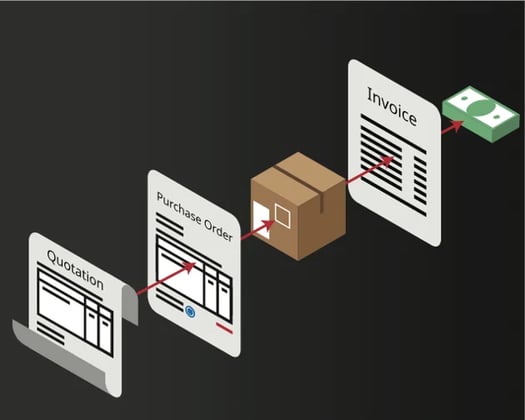

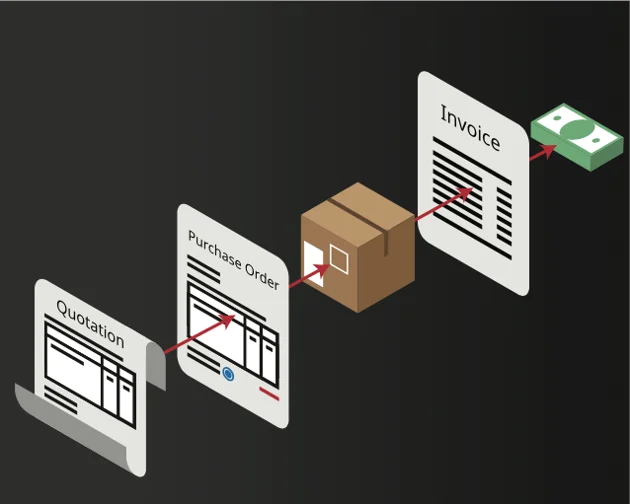

A No PO No Pay policy is a strategic approach implemented by businesses to streamline their procurement processes. It requires suppliers to provide a valid purchase order (PO) before payment can be made. This policy ensures that all purchases are properly authorised, documented, and aligned with the company's procurement guidelines.

By enforcing a No PO No Pay policy, organisations can effectively control their spending, eliminate unauthorised purchases, prevent fraud, and improve financial accountability. It also promotes transparency and helps maintain accurate records of all procurement activities.

Benefits of Implementing a No PO No Pay Policy

Implementing a No PO No Pay policy offers several benefits for businesses. Firstly, it helps in reducing maverick spending, which refers to unauthorised or non-compliant purchases. By enforcing the policy, organisations can ensure that all purchases are in line with their procurement guidelines, avoiding unnecessary expenses and potential risks.

Additionally, the policy enhances supplier relationships and encourages timely communication. Suppliers are aware of the procurement process requirements and are more likely to provide accurate and timely information. This fosters collaboration and improves the overall efficiency of the procurement cycle.

Furthermore, a No PO No Pay policy improves financial control and visibility. It enables organisations to track and monitor expenses more effectively, ensuring better budget management and cost control. By eliminating the risk of duplicate or fraudulent payments, businesses can safeguard their financial resources and maintain a healthy bottom line.

Overall, implementing a No PO No Pay policy can streamline procurement processes, enhance efficiency, and contribute to the overall success of the organisation.

View our featured insights videos for invoice automation, including Tips and Tricks and Best Practice for Procure to Pay (P2P) and Accounts Payable

Challenges and Solutions in Adopting a No PO No Pay Policy

Implementing a No PO No Pay policy can be highly beneficial, but it may also pose certain challenges. One of the major obstacles is resistance from stakeholders who are accustomed to traditional procurement processes. Adjusting to the new policy may be difficult for them, and they may resist change.

To overcome this challenge, companies need to invest in change management efforts. Educating and training employees and suppliers about the policy and its benefits is crucial. Clear communication and continuous support can help to establish a positive mindset towards the new procurement approach.

Another challenge is the potential delay in payments due to policy requirements. This can impact supplier relationships and create dissatisfaction. To address this, companies can establish efficient and streamlined processes for PO creation, approval, and payment. Automation and digitisation of procurement systems can significantly reduce processing time and ensure timely payments.

Adding invoice automation can offer numerous benefits for businesses. One of the key advantages is the ability to eliminate manual data entry and reduce the risk of human error. With automated invoice processing, invoices can be scanned or digitally captured, and the relevant information can be extracted and entered into the system automatically. This saves time and improves accuracy, ensuring that invoices are processed correctly and promptly.

Another benefit of invoice automation is improved efficiency in the approval process. Instead of manually routing invoices for approval, automated systems can streamline the workflow by automatically sending invoices to the appropriate approvers based on predefined rules. This eliminates the need for physical paperwork and reduces the chance of delays or lost invoices. Additionally, automated reminders and notifications can be set up to ensure timely approvals and payments.

Another benefit of invoice automation is improved efficiency in the approval process. Instead of manually routing invoices for approval, automated systems can streamline the workflow by automatically sending invoices to the appropriate approvers based on predefined rules. This eliminates the need for physical paperwork and reduces the chance of delays or lost invoices. Additionally, automated reminders and notifications can be set up to ensure timely approvals and payments.

Furthermore, invoice automation can provide businesses with better visibility and control over their financial processes. Automated systems can generate real-time reports and analytics, allowing businesses to track invoice status, identify bottlenecks, and make informed decisions to optimise their operations. By gaining insights into their invoice processing, businesses can identify areas for improvement, optimise cash flow, and enhance overall financial management.

Best Practices for Successful Implementation

To ensure the successful implementation of a No PO No Pay policy, organisations can follow some best practices. Firstly, they should establish clear and well-defined procurement guidelines and policies, outlining the requirements for creating and approving purchase orders.

To ensure the successful implementation of a No PO No Pay policy, organisations can follow some best practices. Firstly, they should establish clear and well-defined procurement guidelines and policies, outlining the requirements for creating and approving purchase orders.

It is also important to establish effective communication channels with suppliers. Clear and timely communication about the policy requirements, documentation, and payment processes can help in building strong relationships and ensuring compliance.

Automation and digitisation of procurement systems can greatly enhance efficiency. Implementing a robust ERP system, such as Oracle ERP, can streamline the entire procurement cycle, from requisition to payment, ensuring accurate and timely processing of purchase orders and payments.

Regular audits and monitoring can help in identifying and addressing any non-compliance issues. Continuous training and education of employees and suppliers can also contribute to the successful implementation of the policy.

By following these best practices, organisations can maximise the benefits of a No PO No Pay policy and achieve streamlined procurement processes.

How to get staff on board with using new accounts payable software

People don’t like change. Changing long-established ways of working is hard, and learning new software is hard. After seeing first-hand what it takes to successfully implement new accounts payable software, here are our top tips for getting your users on board with the new processes.