Why Invoice Processing Is the Front Line of B2B Payment Fraud

When finance teams discuss B2B payment fraud, the focus is usually on cybercrime, email scams, or external attackers. But in most cases, the real entry point is much closer to home: the invoice.

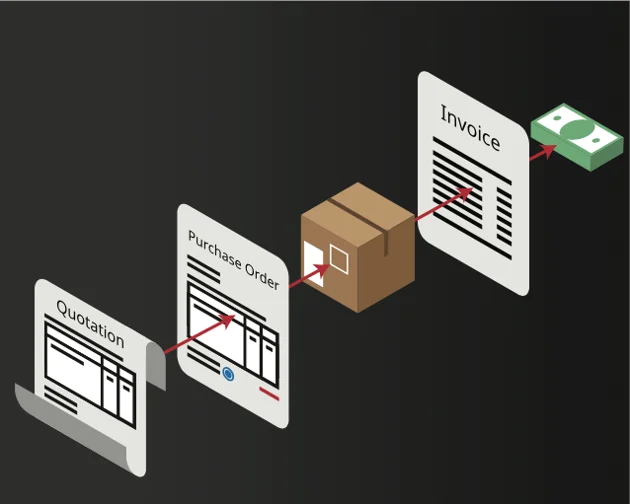

Invoices sit at the centre of accounts payable. They initiate payments, drive cash out of the business, and pass through multiple systems and hands. That makes invoice processing the most attractive target for fraud—and one of the most frequently underestimated risks.

As invoice volumes increase, teams become more distributed, and pressure on AP grows, the weaknesses in traditional, manual invoice processing are becoming impossible to ignore.