Is Straight Through Processing the Answer

Efficient Accounts Payable Processing?

Why automate?

The Financial Controller at a leading organisation walked into her Accounts Payable department to discover they were struggling to process invoices, even with a supposedly automated solution. She started to investigate alternative solutions and thought that maybe one of the key areas would be around how to maximize straight-through processing.

But what is Straight Through Processing and what does that mean?

And is this the right question

We are always asked, what is your recognition rate, how many invoices will go straight through?

Is this relevant and what factors really impact the ability to achieve this?

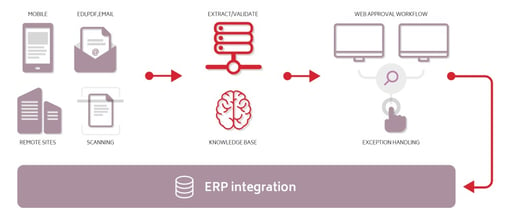

Straight-through processing means that when an invoice is received by an organisation, it goes directly into their ERP platform for payment without any manual intervention. How is this achieved?

Why not request a demonstration of Mi Invoices to learn more about why there is more to this topic than just a percentage?

Below are some key factors that impact the ability to enable straight-through processing;

![]() The first question is what is your percentage of PO, (Purchase Order) to Non-PO as this is the highest match rate achievable.

The first question is what is your percentage of PO, (Purchase Order) to Non-PO as this is the highest match rate achievable.

![]()

You need to consider that 100% is never achievable as certain invoices such as utility bills do not require a PO to send you an invoice.

![]() Then we hear from customers – “Yes, we are 100% PO but typically we raise the PO after the invoice arrives, (Retrospective Purchase orders)! Once we receive the invoice, then we receipt the goods.”

Then we hear from customers – “Yes, we are 100% PO but typically we raise the PO after the invoice arrives, (Retrospective Purchase orders)! Once we receive the invoice, then we receipt the goods.”

![]()

The next question is how many of your invoices match 1st time without manual intervention?

![]()

How good and timely is your Goods Receipt Note (GRN) process?

Typically this is highly dependent on your industry, is your organisation working to Just in Time ( JIT ) and the goods are receipted by your goods in department or do your project teams undertake this once a week? Or even does it take several weeks for the goods to reach their destination before the project team can apply the GRN! What about service-based invoices? How timely are these receipted?

![]()

Do you need to match your invoices at the Line level or at the Header?

That’s before we get to the thorny questions, how good are your suppliers at invoicing correctly and critically how good is your master data!

Matching the extracted data to the Supplier Master Data held within the client’s ERP is the next step. If everything matches, it is within tolerance, and correct, the invoice can then pass straight through to the ERP without any human intervention.

Taking into account all these points is straight-through processing the answer and what does that mean?

See our Oracle sponsored blog, for the critical pillars of automated invoice processing into Oracle ERP platforms

Is Straight Through Processing really possible?

We are left with the obvious statement, that 100% straight-through processing is rarely possible and manual intervention is inevitably going to be necessary.

Critically the actual question which should be asked of a supplier’s system;

How simple is it to process the exceptions with a minimal amount of time and effort?

This is the real area you need to focus on when looking at solutions to automate your invoice processing. Not the simple question “what is your recognition rate to enable straight-through processing.”

You can also have a major effect on the required processing time and effort by reviewing your master data and undertaking a data cleansing activity. Including the removal of redundant suppliers and ensuring your current supplier address details are complete!

So what functions and capabilities are needed and what can you do to maximise efficiency?

Critical areas you need to focus on are;

![]() Complete Integration with your ERP platform to extract the required master data, which can be used to automatically validate the Invoice.

Complete Integration with your ERP platform to extract the required master data, which can be used to automatically validate the Invoice.

![]()

A simple user-friendly interface, to minimise the number of keystrokes and mouse clicks to process the invoices. This also aids acceptance and reduces training needs.

![]() The purchase order data needs to be complete, to assist in receiving accurate vendor invoices and created before the invoice is sent to you.

The purchase order data needs to be complete, to assist in receiving accurate vendor invoices and created before the invoice is sent to you.

![]() The platform needs to simplify the process for the AP team to route the exceptions to required users for resolution and approval. This should also apply to rejections whether back to a supplier or a user.

The platform needs to simplify the process for the AP team to route the exceptions to required users for resolution and approval. This should also apply to rejections whether back to a supplier or a user.

![]()

Once all of the data is corrected and validated, the invoice is submitted to the ERP platform for onward processing. This should be achieved by tight integration that can dynamically push the invoice directly into approved ERP interfaces. Ideally, this should be for each invoice, as a flat file with a batch of invoices will fail if there is an error on any single invoice.

Want to learn more? Access our library of videos on best practice advice, for automated invoice processing within P2P and Accounts Payable on enhancing the processing of your supplier invoices

Is it necessary to apply OCR to a PDF invoice in order to automate invoice processing?

There are many solutions that will allow a whole range of file formats that can be imported. Document restrictions for invoice automation are not new, however, solutions are becoming more flexible in allowing additional formats. but this may not be the correct approach though for several reasons.

Firstly, there is an impact on the ability to extract the data or OCR the document to read the characters. Secondly, you must consider legal admissibility in terms of whether you should be receiving documents that can be edited, as there are technical implications for these, but the primary concern should be admissibility.

Eight ways your accounts payable team can communicate with suppliers

Best Practices for your Accounts Payable team to communicate with your suppliers when implementing change

Change is hard. When implementing new technology, whether it’s Oracle ERP Cloud, EBusiness Suite or something else, you have to remember that, even if it is going to enhance the way people do their job, careful consideration needs to be given to how that change is going to be implemented.